UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

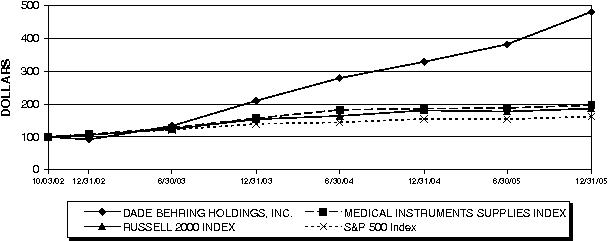

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x |

Filed by a Party other than the Registrant o |

Check the appropriate box: |

o | Preliminary Proxy Statement |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x | Definitive Proxy Statement |

o | Definitive Additional Materials |

o | Soliciting Material Pursuant to §240.14a-12 |

Dade Behring Holdings, Inc. |

(Name of Registrant as Specified In Its Charter) |

N/A |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

Payment of Filing Fee (Check the appropriate box): |

x | No fee required. |

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| | |

| (2) | Aggregate number of securities to which transaction applies: |

| | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| (4) | Proposed maximum aggregate value of transaction: |

| | |

| (5) | Total fee paid: |

| | |

o | Fee paid previously with preliminary materials. |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| | |

| (2) | Form, Schedule or Registration Statement No.: |

| | |

| (3) | Filing Party: |

| | |

| (4) | Date Filed: |

| | |

| | Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

March 26, 2007

Dear Fellow Dade Behring Shareholder:

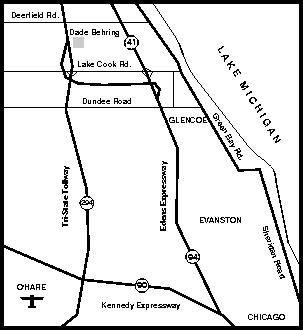

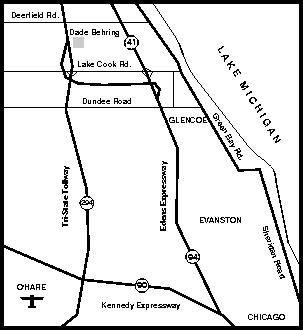

It is my pleasure to invite you to the 20062007 Annual Meeting of Shareholders of Dade Behring Holdings, Inc. to be held on Wednesday,Thursday, May 24, 2006,3, 2007, at 3:00 p.m. Central Daylight Time at the Dade Behring Executive Offices, 1717 Deerfield Road, Deerfield, Illinois. You will find directions to the meeting on the back cover of the accompanying Proxy Statement.

At the Annual Meeting, if you are a holder of Dade Behring common stock, we will ask you to elect four directors.two directors and approve the amendment and restatement of the Dade Behring 2004 Incentive Compensation Plan.

We will also review the progress of the Company during the past year and report on matters of interest to Dade Behring shareholders.

This booklet includes the Notice of the 20062007 Annual Meeting and the Proxy Statement. The Proxy Statement describes the business that we will conduct at the Annual Meeting. The Proxy Statement and the Company’s Annual Report to Shareholders for the fiscal year ended December 31, 20052006 provide information about the Company you should consider when you vote your shares.

It is important that your shares will be represented and voted at the Annual Meeting. If you plan to attend, please check the box provided on the proxy card. Whether or not you plan to attend the Annual Meeting in person, we urge you to complete, sign and return the enclosed proxy card in the accompanying postage-paid envelope, or to vote by telephone.

| | Sincerely, |

|

| /s/ JIM REID-ANDERSON | |

| | Jim Reid-Anderson

Chairman of the Board, President

and Chief Executive Officer | |

1717 Deerfield Road, Deerfield, IL 60015

NOTICE OF THE 20062007 ANNUAL MEETING OF SHAREHOLDERS

April 12, 2006March 26, 2007

To our Shareholders:

THE 20062007 ANNUAL MEETING OF SHAREHOLDERS OF DADE BEHRING HOLDINGS, INC., a Delaware corporation (the “Company”), will be held on Wednesday,Thursday, May 24, 2006,3, 2007, at 3:00 p.m. Central Daylight Time at the Dade Behring Executives Offices, 1717 Deerfield Road, Deerfield, Illinois, for the following purposes:

1. To elect threetwo directors to hold office for three years and one director to hold office for two years; and

2. To approve the amendment and restatement of the Dade Behring 2004 Incentive Compensation Plan; and

3. To transact such other business as may properly come before the Annual Meeting.

Only shareholders of record at the close of business on March 27, 20068, 2007 will be entitled to vote at the Annual Meeting.

A copy of the Company’s Annual Report to Shareholders for the fiscal year ended December 31, 20052006 is being mailed to you with this Notice and the Proxy Statement.

| | By order of the Board of Directors, |

|

| /s/ LOUISE S. PEARSON | |

| | Louise S. Pearson

Vice President General Counsel and Corporate Secretary | |

All shareholders are cordially invited to attend the Annual Meeting, but whether or not you expect to attend the Annual Meeting in person, please vote your shares by proxy, either by completing, signing, and returning the enclosed proxy card in the postage-paid envelope provided, or by calling the telephone number and following the instructions provided on your proxy card.

DADE BEHRING HOLDINGS, INC.

1717 Deerfield Road, Deerfield, IL 60015

PROXY STATEMENT

FOR THE 20062007 ANNUAL MEETING OF SHAREHOLDERS

ABOUT OUR ANNUAL MEETING

Why have I received these materials?

The accompanying proxy, which is being mailed and made available electronically to shareholders on or about April 12, 2006,March 26, 2007, is solicited by the Board of Directors of Dade Behring Holdings, Inc. (referred to throughout this Proxy Statement as “Dade Behring,” “the Company,” “we” and “us”) in connection with our Annual Meeting of Shareholders that will take place on Wednesday,Thursday May 24, 20063, 2007 at 3:00 p.m. Central Daylight Time at the Dade Behring Executive Offices, 1717 Deerfield Road, Deerfield, Illinois. You are cordially invited to attend the Annual Meeting and are requested to vote foron each of the individuals nominated for election as a Dade Behring director.proposal described in this Proxy Statement.

Who is entitled to vote at the Annual Meeting?

Shareholders at the close of business on March 27, 20068, 2007 will be entitled to notice of and to vote at the Annual Meeting. As of such date, there were 88,160,62182,471,636 shares of Dade Behring common stock outstanding, each entitled to one vote.vote with respect to each matter to be voted upon at the Annual Meeting.

How do I vote my shares at the Annual Meeting?

If you are a “record” shareholder of common stock (that is, if you hold common stock in your own name in Dade Behring’s stock records maintained by our transfer agent, Mellon Shareholder Services), you may vote your shares by completing and signing the accompanying proxy card and returning it to Dade Behring by mail or delivering it in person. If you vote your shares using the proxy card, Dade Behring must receive your completed and signed proxy card no later than when proxy holders vote the shares represented by proxies at the Annual Meeting. In addition, shareholders in the United States may vote by using a toll-free telephone number by following the instructions included with your proxy card. The telephone voting facilities for shareholders of record will close at 11:59 P.M. Eastern Standard Time on May 23, 2006.2, 2007.

“Street name” shareholders of common stock (that is, shareholders who hold common stock through a broker or other nominee) should follow the instructions provided by their broker or nominee to instruct the broker or nominee how to vote.

Can I change my vote after I return my proxy card or after I vote by telephone?

Yes. After you have submitted a proxy, you may change your vote at any time before the proxy is exercised by submitting a notice of revocation or a proxy bearing a later date. Regardless of whether you voted using the proxy card or by telephone, you may change your vote either by submitting a proxy card or by voting by telephone prior to the time at which the telephone voting facilities close by following the procedures applicable to those methods of voting. In each event, the later submitted vote will be recorded and the earlier vote revoked. In addition, you may vote or change your vote by casting a ballot in person at the Annual Meeting. If you hold your shares in street name, you will need to follow the instructions for changing your vote that you receive from the institution that holds your shares.

What constitutes a quorum for purposes of the Annual Meeting?

The presence at the Annual Meeting in person or by proxy of the holders of a majority of the voting power of all outstanding shares of common stock entitled to vote will constitute a quorum for the transaction of business. Proxies marked as abstaining (and proxies containing broker non-votes) on any

matter to be acted upon by shareholders will be treated as present at the meeting for purposes of determining a quorum but will not be counted as votes cast on such matters.

What vote is required to approve aeach proposal?

The election of directors at the Annual Meeting requires the affirmative vote of a plurality of the votes cast at the Annual Meeting by shares represented in person or by proxy and entitled to vote for the election of directors. This means that the fourtwo nominees for director who receive the most affirmative votes will be elected.

The proposal to amend and restate the Dade Behring 2004 Incentive Compensation Plan and each other matter that properly comes before the Annual Meeting will require the affirmative vote of a majority of the shares represented in person or by proxy at the Annual Meeting.

What effect does an abstention have?

A properly executed proxy marked “ABSTAIN” with respect to any matter will not be voted, although it will be counted for purposes of determining whether there is a quorum. An abstention will have no effect on the outcome of the election of directors, but an abstention on the proposal to amend and restate the Dade Behring 2004 Incentive Compensation Plan and on any other matter properly brought before the Annual Meeting will have the effect of a negative vote on that matter. If you hold your shares in “street name” through a broker or other nominee, shares represented by “broker non-votes” will be counted in determining whether there is a quorum, but will not be counted as votes cast on any matter.

What are “broker non-votes”?

If you hold shares through a broker, bank or other nominee, generally the nominee will vote the shares for you in accordance with your instructions. Stock exchange and NASD rules prohibit a broker from voting shares held in a brokerage account on some proposals (a “broker non-vote”) if the broker does not receive voting instructions from you. For example, if you hold shares through a broker, that broker is prohibited from voting on our proposal to approve the amendment and restatement of the Dade Behring 2004 Incentive Compensation Plan if the broker does not receive voting instructions from you with respect to that proposal. Shares that are represented by proxy, butin which the broker has not been given voting instructions as to any proposal that are not voted on a particular matteris subject to the broker non-vote rule, are counted for determining the quorum but are not voted on the particular matter.such proposal.

How does the Board recommend that I vote my shares?

Unless you give other instructions on your proxy card, the persons named as proxy holders on the proxy card will vote in accordance with the recommendations of the Board of Directors. The Board unanimously recommends a vote FOR the election of the nominated directors.directors and FOR the proposed amendment and restatement of the Dade Behring 2004 Incentive Compensation Plan.

With respect to any other matter that properly comes before the Annual Meeting, the proxy holders will vote as recommended by the Board of Directors or, if no recommendation is given, in the proxy holders’ own discretion in the best interests of Dade Behring. At the date this Proxy Statement went to press, the Board of Directors had no knowledge of any business other than the election of fourtwo directors and the proposal to approve the amendment and restatement of the Dade Behring 2004 Incentive

Compensation Plan described in this Proxy Statement that will be presented for consideration at the Annual Meeting.

Who will bear the expense of soliciting proxies?

Dade Behring will bear the cost of soliciting proxies for the Annual Meeting. In addition to the solicitation by mail, proxies may be solicited personally or by telephone, facsimile or electronic transmission by our employees. We will reimburse brokers holding common stock in their names or in the names of their nominees for their expenses in forwarding the proxy materials to the beneficial owners of our common stock.

How may a shareholder make a proposal or nominate a candidate for election as a director?

Any shareholder who intends to present a proposal at Dade Behring’s annual meeting of shareholders to be held in 2007 and who wishes to have the proposal included in Dade Behring’s proxy statement for that meeting must deliver the proposal to Louise S. Pearson, the Corporate Secretary, by no later than

December 13, 2006. All proposals must satisfy the rules and regulations of the Securities and Exchange Commission to be eligible for inclusion in the proxy statement.

Shareholders may present proposals that are proper subjects for consideration at an annual meeting, even if the proposal is not submitted by the deadline for inclusion in the proxy statement. To do so, the shareholder must comply with the procedures specified in Dade Behring’s bylaws. The bylaws require all shareholders who intend to make proposals at an annual meeting to submit their proposals to the Corporate Secretary not fewer than 90 and not more than 120 days before the anniversary date of the previous year’s annual meeting.

The bylaws also provide that nominations for director may only be made by the Board of Directors (or an authorized board committee) or by a shareholder entitled to vote who sends notice to Dade Behring not fewer than 90 nor more than 120 days before the anniversary date of the previous year’s annual meeting and complies with the procedures and requirements specified in Dade Behring’s bylaws.

To be eligible for consideration at the 2007 annual meeting, proposals which have not been submitted by December 13, 2006 and nominations for director must be received by the Corporate Secretary between January 24, 2007 and February 23, 2007. This advance notice period is intended to allow all shareholders to have an opportunity to consider all business and nominees expected to be considered at the meeting.

All submissions to, or requests from, the Corporate Secretary should be made to Dade Behring’s principal executive offices at 1717 Deerfield Road, Deerfield, Illinois 60015-0778. A copy of Dade Behring’s bylaws is available, without charge, upon written request to the Corporate Secretary at that address and on Dade Behring’s Internet site at www.dadebehring.com.

How may I obtain electronic access to proxy materials and annual reports to shareholders?

This Proxy Statement and Dade Behring’s 20052006 Annual Report to Shareholders are available on Dade Behring’s Internet site at www.dadebehring.com. Most shareholders can elect to view future proxy statements and annual reports over the Internet instead of receiving paper copies in the mail. If you are a record shareholder, you can choose this alternative and save Dade Behring the cost of producing and mailing these documents by following the instructions provided on your proxy card or by following the instructions provided if you vote by telephone. If you are a street name shareholder, please refer to the information provided by the institution that holds your shares and follow that institution’s instructions on how to elect to view future proxy statements and annual reports over the Internet.

3

PROPOSALS

ELECTION OF DIRECTORSProposal 1—Election of Directors

Our Board of Directors currently consists of eight members and is divided into three classes, Class 1, Class 2 and Class 3. Each year, the directors in one of the three classes are elected to serve a three-year term. Messrs. N. Leigh Anderson Ph.D. and James W. P. Reid-Anderson, Jeffrey D. Benjamin and Alan S. CooperG. Andress are Class 12 directors and have been nominated and unanimously recommended by the Board of Directors for election at the Annual Meeting. If elected, each of them will serve until our 20092010 annual meeting and until his successor has been duly elected and qualified or until his earlier resignation or removal. In addition, Ms. Beverly A. Huss is a Class 3 director and has been nominated and unanimously recommended by the Board of Directors for election at the Annual Meeting. If elected, she will serve until our 2008 annual meeting and until her successor has been duly elected and qualified or until her earlier resignation or removal. The Class 2 directors will be considered for election at our 2007 annual meeting. The Class 3 directors will be considered for election at our 2008 annual meeting. The Class 1 directors will be considered for election at our 2009 annual meeting.

Directors will be elected by the affirmative vote of a plurality of the votes cast at the Annual Meeting.

Information with respect to Nominees and Continuing Directors

The following table sets forth information as of the Annual Meeting date for persons who serve as our directors.

Name | | Age | | Position | | Term

Expires | | Audit

Committee

Member | | Compensation

Committee

Member | | Governance

Committee

Member | | | | | Age | | Position | | Term

Expires | | Audit

Committee

Member | | Compensation

Committee

Member | | Governance

Committee

Member | |

James W. P. Reid-Anderson | | | 47 | | | Chairman, President

and CEO | | | 2006 | | | | | | | | | | | | | | | James W. P. Reid-Anderson | | 48 | | Chairman, President and CEO | | | 2009 | | | | | | | | | | | | | | |

N. Leigh Anderson, Ph.D. | | | 56 | | | Director | | | 2007 | | | | X | | | | | | | | | | | N. Leigh Anderson, Ph.D. | | 57 | | Director | | | 2007 | | | | X | | | | | | | | | | |

James G. Andress | | | 67 | | | Director | | | 2007 | | | | | | | | X | | | | X | | | James G. Andress | | 68 | | Director | | | 2007 | | | | | | | | X | | | | X | | |

Jeffrey D. Benjamin | | | 44 | | | Director | | | 2006 | | | | | | | | X | | | | X | | | Jeffrey D. Benjamin | | 45 | | Director | | | 2009 | | | | | | | | X | | | | X | | |

Alan S. Cooper | | | 47 | | | Director | | | 2006 | | | | | | | | X | | | | X | | | Alan S. Cooper | | 48 | | Director | | | 2009 | | | | | | | | X | | | | X | | |

Beverly A. Huss. | | | 46 | | | Director | | | 2006 | | | | | | | | X | | | | X | | | Beverly A. Huss. | | 47 | | Director | | | 2008 | | | | | | | | X | | | | X | | |

Richard W. Roedel | | | 56 | | | Director | | | 2008 | | | | X | | | | | | | | | | | Richard W. Roedel | | 57 | | Director | | | 2008 | | | | X | | | | | | | | | | |

Samuel K. Skinner | | | 67 | | | Director | | | 2008 | | | | X | | | | | | | | | | | Samuel K. Skinner | | 68 | | Director | | | 2008 | | | | X | | | | | | | | | | |

Nominees for Election at this Annual Meeting (Class 1 and Class 3)2)

N. Leigh Anderson, Ph.D. was appointed as a director on October 3, 2002 and is a member of the Audit Committee. Dr. Anderson is Founder and Chief Executive Officer of the Plasma Proteome Institute, or PPI, in Washington, D.C. Dr. Anderson also consults through Anderson Forschung Group, where he is a Principal. Prior to founding PPI, he was Chief Scientific Officer at Large Scale Biology Corporation, or LSBC, whose proteomics division he founded in 1985 and led as Chief Executive Officer prior to its merger in 1999 with Biosource Technologies, which created the current LSBC. He founded, along with Dr. Norman Anderson, the Molecular Anatomy Program at the Argonne National Laboratory in Chicago where his work in the development of 2-D electrophoresis and molecular database technology earned him, among other distinctions, the American Association for Clinical Chemistry’s Young Investigator Award for 1982 and the 1983 Pittsburgh Analytical Chemistry Award. Dr. Anderson also serves as a director of publicly-held Luna Innovations Incorporated, a manufacturer of molecular technology and sensor products and a provider of contract research and development services.

James G. Andress was appointed as a director on October 3, 2002 and is Chairperson of the Compensation Committee and a member of the Governance Committee. From 1996 through 2000, Mr. Andress served as President and Chief Executive Officer of Warner Chilcott, PLC. Warner Chilcott is a pharmaceutical company that develops prescription drugs in the areas of women’s health care, urology, dermatology and cardiology. He was appointed Chairman of Warner Chilcott, PLC in 1998. Mr. Andress is a director and Chairman of the Audit Committee of publicly-held The Allstate Corporation; a director and

Chairman of the Audit Committee of publicly-held Xoma Corporation, a biopharmaceutical development company; and a director and Chairman of the Audit Committee of publicly-held Warner Chilcott Pty. Ltd., a research based pharmaceutical company. Mr. Andress also serves as a director of publicly-held Sepracor Inc., a research based pharmaceutical company.

Directors with Terms Expiring in 2008 (Class 3)

Beverly A. Huss was appointed as a director on July 28, 2005 and is a member of the Compensation and Governance Committees. Ms. Huss has been President and Chief Executive Officer of Exploramed NC3, an early stage medical device company since January 2007. Prior to that Ms. Huss had been employed by Guidant Corporation, a manufacturer of surgical and medical instruments where she had held positions of increasing responsibility since 1986 and most recently was President of the Endovascular Solutions division. Ms Huss was an engineer with Honeywell Inc. from 1984 to 1986 and with Jones and Laughlin Steel, Inc. from 1982 to 1984. Ms. Huss is a director of publicly-held Wright Medical Technology, Inc., a designer, manufacturer and distributor of orthopedic implant devices. Ms. Huss is Chairman of the Board of the Santa Clara County (California) chapter of the American Heart Association. Ms. Huss holds an M.S. in technology management from Pepperdine University and a B.S. in metallurgical engineering from the University of Illinois.

Richard W. Roedel was appointed as a director on October 3, 2002 and is Chairperson of the Audit Committee. From 1985 through 2000, he was employed by BDO Seidman, LLC in positions ranging from Audit Partner, to his final promotion in 1999 to Chairman and Chief Executive Officer. In October of 2002, he joined the Board of Directors of Take-Two Interactive Software, Inc. as Chairman of the Audit Committee and served in several capacities through June 2005, including Chairman and Chief Executive Officer. Mr. Roedel is a director and Chairman of the Audit Committee of publicly-held Brightpoint, Inc., a distributor of wireless devices, accessories and services in the wireless telecommunications and data industry and a director and Chairman of the Audit Committee of publicly-held Luna Innovations Incorporated, a manufacturer of molecular technology and sensor products and a provider of contract research and development services. He is also a director of publicly-held IHS, Inc., a global provider of critical technical information, decision support tools and related services and a director of publicly-held Sealy Corporation, a bedding manufacturer. Mr. Roedel also serves as a director of the Association of Audit Committee Members, Inc., a not-for-profit organization dedicated to strengthening the audit committee by developing best practices. Mr. Roedel holds a B.S. in Accounting and Economics from The Ohio State University and is a Certified Public Accountant.

Samuel K. Skinner was appointed as a director on February 18, 2004 and is a member of the Audit Committee. Mr. Skinner was President and Chief Executive Officer of USFreightways from July 2000 to May 2003 and in addition was Chairman of the Board of USFreightways from January 1, 2003 through May 2003. From October 1998 to July 2000, Mr. Skinner was a partner and Co-Chairman of the law firm of Hopkins & Sutter. From February 1993 to April 1998, he was President and a director of Commonwealth Edison Company and its parent company, Unicom Corporation. Prior to joining Commonwealth Edison, he served as Chief of Staff to former President George H. Bush. Prior to his White House service, Mr. Skinner served in the President’s cabinet for nearly three years as U.S. Secretary of Transportation. From 1977 to 1989, Mr. Skinner practiced law as a senior partner in the Chicago law firm of Sidley & Austin (now Sidley Austin). From 1984 to 1988, while practicing law full time, he also served as Chairman of the Regional Transportation Authority of Northeastern Illinois and was appointed by President Reagan as Chairman of the President’s Commission on Organized Crime. From 1968 to 1975, Mr. Skinner served in the office of the United States Attorney for the Northern District of Illinois and in 1977 President Ford appointed him United States Attorney, one of the few career prosecutors to ever hold such a position. Mr. Skinner is a director of publicly-held; DiamondCluster International Inc., a global provider of management consulting services; Express Scripts, Inc., a provider of pharmacy benefit management

services; Midwest Air Group, Inc., a licensed commercial air carrier; and Navigant Consulting, Inc., a provider of financial, litigation, healthcare and energy consulting services. Mr. Skinner also serves as a director of several private companies.

Directors with Terms Expiring in 2009 (Class 1)

James W. P. Reid-Anderson was elected to the Board of Directors in 2000 and was named Chairman of the Board of Directors in October 2002. Mr. Reid-Anderson has served as President and Chief Executive Officer since September 2000. Mr. Reid-Anderson joined us in 1996 as Executive Vice President and Chief Financial Officer for Dade Behring Inc. and became Chief Administrative Officer and Chief Financial Officer in September 1997, responsible for all headquarters functions after the combination of Dade and Behring. In April 1999, Mr. Reid-Anderson was promoted to President and Chief Operating Officer. From 1994 to 1996, Mr. Reid-Anderson worked for Wilson Sporting Goods where he served as Chief Operating Officer and Chief Administrative Officer. In addition, Mr. Reid-Anderson had responsibility for the company’s international unit. He also held financial positions of increasing responsibility at PepsiCo, Inc., Grand Metropolitan PLC and Mobil Oil Corporation, with roles based in Europe, Asia and North America. Mr. Reid-Anderson is a fellow of the Association of Chartered Certified Accountants and holds a degree with honors from the University of Birmingham in England.

Jeffrey D. Benjamin was appointed as a director on October 3, 2002 and is a member of the Compen-sationCompensation and Governance Committees. Mr. Benjamin has been Senior Adviser to Apollo Management, L.P., a private investment firm, since September 2002. From January 2002 until September 2002, he was Managing Director of Libra Securities LLC, an investment banking firm. Previously, he served as

Co-Chief Executive Officer of U.S. Bancorp Libra, an investment banking firm, from January 1999 until December 2001. Mr. Benjamin is a director of publicly held Chiquita Brands International,publicly-held Goodman Global, Inc., an international producera manufacturer of heating, ventilating and distributor of fresh produce;air conditioning equipment; Exco Resources, Inc., engaged in the development and exploitation of oil and natural gas properties in North America; and NTL Incorporated,Virgin Media Inc., a cable and broadband supplier of communications and entertainment services primarily in the United Kingdom.

Alan S. Cooper was appointed as a director on October 3, 2002 and is Chairperson of the Governance Committee and a member of the Compensation Committee. Since April 1, 2003, Mr. Cooper has been a Managing Partner of Jet Capital Management, a New York based private investment firm specializing in risk arbitrage, capital structure arbitrage and other event-driven investing. Prior to such time, Mr. Cooper had been a Principal of Redwood Capital Management hedge fund located in Englewood Cliffs, New Jersey from 2000 to March 2003. Prior to joining Redwood Capital, he served as General Counsel to Dickstein Partners, Inc. from 1992 to 2000 and also as Vice President beginning in 1994.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS

THAT YOU VOTE FOR THE ELECTION OF MESSRS. N. LEIGH ANDERSON Ph.D.

AND JAMES G. ANDRESS AS CLASS 2 DIRECTORS

6

Beverly A. HussProposal 2—Amendment and Restatement of the Dade Behring 2004 Incentive Compensation Plan

We are asking shareholders to approve an amendment and restatement of the Dade Behring 2004 Incentive Compensation Plan (the “Plan”) that will effect the following changes:

(A) was appointedauthorize 7,500,000 additional shares of our common stock to be issued under the Plan with no more than 1,000,000 shares to be used for awards other than stock options and cash-based awards; and

(B) approve certain changes to Plan administration and the addition of return on invested capital as a directorpotential performance measure for awards under the Plan.

The Board of Directors adopted the amendment and restatement on July 28, 2005February 8, 2007, subject to shareholder approval at the Annual Meeting.

The proposed authorization of an additional 7,500,000 shares of Company common stock to be issued under the Plan is essential to our continuing effort to attract and retain qualified and experienced individuals to serve as key employees and members of our Board of Directors at a time when the responsibilities and obligations required of them are increasing. Also, we are required to periodically resubmit plans intended to provide performance based compensation for shareholder approval so that the plan may continue to qualify under Section 162(m) of the Internal Revenue Code of 1986, as amended (“Code”) which permits a federal income tax deduction for performance based compensation. As of February 8, 2007, we had approximately 500,000 shares available for issuance under the Plan. We believe that the additional shares of common stock that will become available under the Plan will allow us to offer the competitive equity compensation we need to maintain dedicated management staff and executive leadership and highly-qualified individuals to serve as non-employee members of our Board.

The amendments to add return on invested capital as an additional potential performance measure for awards that are subject to Performance Goals, as described below and to clarify that stock options may be made the subject of performance criteria will allow more flexibility in designing future awards.

The amendment also provides that share-related awards settled in cash or not issued because they were tendered by a participant or retained by the Company as payment of the exercise price or to satisfy tax withholding obligations will not be available for future grants under the Plan, and thereby introduces a more conservative policy for determining the number of shares that remain issuable under the Plan.

The amendment permits the Company to amend the Plan or any outstanding award, as the Company deems appropriate, to avoid or mitigate the imposition of additional taxes under the deferred compensation requirements of section 409A of the Code enacted after the original establishment of the Plan.

The amendment extends the time period, from six months to twelve months, during which vested stock options granted after May 3, 2007 may be exercised by a participant whose service is terminated on account of disability or by the participant’s personal representative or estate in the case of either termination on account of death or the death of a participant following termination. The extended stock option exercise period applies when no other time period is stated in the award and facilitates tax planning and estate administration for the benefit of participants and their beneficiaries.

The amendment gives the Committee the authority to establish processes and procedures to determine the participant’s beneficiaries. The Company believes this authority is necessary and desirable in order to clarify the distribution of benefits under the Plan after a participant’s death.

The purpose of the Plan continues to be to attract, retain and motivate employees, officers and directors by providing them with the opportunity to acquire a proprietary interest in the Company or other incentives and to align their interests and efforts to the interests of the Company’s shareholders.

The following is a summary of the principal features of the Plan, as amended and restated, which is filed with the Securities and Exchange Commission as Appendix A to this Proxy Statement and is incorporated herein by reference. The following summary is not intended to be a membercomplete description of the Compensation and Governance Committees. Ms. Huss has been employed by Guidant Corporation,Plan. Please read the Plan for more detailed information. Any shareholder who wishes to obtain a manufacturer of surgical and medical instruments since 1986 where she has held positions of increasing responsibility and most recently was Presidentcopy of the Endovascular Solutions division. From 1982actual Plan documents may do so upon written request to 1986 she held engineering positionsInvestor Relations, Dade Behring Holdings, Inc. P.O. Box 0778, Deerfield, Illinois 60015-0778, or may access the documents from the SEC’s Web site at Honeywell Inc. and Jones & Laughlin. Ms. Husswww.sec.gov. The Plan serves as senior advisorthe successor to Pervasis Therapeutics Corporation, a Cambridge Massachusetts-based company engagedour 2002 Management Stock Option Plan, our 2002 Chief Executive Officer Equity Plan and our 2002 Directors Stock Option Plan (collectively, the Predecessor Plans”) under which no additional options were granted following the initial adoption of the Plan in cell therapy and also serves as Chairman2004.

Administration

The Committee under the Plan administers the Plan. With respect to executive officers, the Compensation Committee of the Board of Directors is the American Heart Association Silicon Valley Chapter. Ms. Huss holds an M.S. in technology management from Pepperdine University and a B.S. in metallurgical engineering fromCommittee under the University of Illinois.

Directors with Terms Expiring in 2007 (Class 2)

N. Leigh Anderson, Ph.D. was appointed as a director on October 3, 2002 and is a memberPlan. With respect to directors, the Governance Committee of the Audit Committee. Dr. AndersonBoard of Directors is Founder andthe Committee under the Plan. With respect to all employees other than executive officers, the Chief Executive Officer of the Plasma Proteome Institute,Company is the Committee under the Plan. The Committee has the authority to administer and interpret the plan, including, among other things, the power to select individuals to whom awards are granted, to determine the types of awards and the number of shares subject to each award, to set the terms and conditions of such awards, to cancel or PPI,suspend awards and to establish procedures pursuant to which the payment of any such awards may be deferred. The Committee also has the authority to adopt such modifications, procedures and sub-plans as may be necessary or desirable to comply with provisions of the laws of any countries in Washington, D.C. Dr. Andersonwhich the Company and its subsidiaries may operate to ensure the viability of the benefits from awards granted to participants employed in such countries, to meet the requirements of local laws that permit the Plan to operate in a qualified or tax-efficient manner, to comply with applicable foreign laws and to meet the objectives of the Plan.

Eligibility

Awards may be granted under the Plan to employees, officers and directors, including non-employee directors, of the Company and its subsidiaries. All employees, officers and non-employee directors (approximately 6,400) are eligible to participate under the Plan. Currently, approximately 340 officers and key employees and all of our non-employee directors have been granted awards.

Types of Awards

The Plan permits the granting of any or all of the following types of awards: (1) stock options, (2) restricted stock and stock units, (3) performance stock and performance units, (4) cash-based awards and (5) stock appreciation rights. In connection with any award or any deferred award, payments may also consults through Anderson Forschung Group, where hebe made representing dividends or their equivalent.

Stock Options. Stock options entitle the holder to purchase a specified number of shares of the Company’s common stock at a specified price, which is called the exercise price, subject to the terms and conditions of the option grant. The exercise price of stock options under the Plan will be at least 100% of the fair market value of the stock on the date of grant, except for certain grants made to assume or convert awards in connection with acquisition transactions. The Committee will fix the term of each option, but no option under the Plan will be exercisable more than ten years after the option is granted. Each option will be exercisable at such time or times as determined by the Committee. Options may be exercised, in whole or in part, by payment in full of the purchase price in a Principal. Priorform acceptable to founding PPI, hethe Committee such as in cash or its equivalent, delivery of shares of the Company’s common stock or by means of a broker-assisted cashless exercise.

After termination of service with the Company or its subsidiaries, a participant will be able to exercise the vested portion of his or her option for the period of time stated in the option agreement. If no such period of time is stated in a participant’s option agreement, a participant will generally be able to exercise his or her option for (i) ninety days following his or her termination for reasons other than cause, death or disability and (ii) twelve months (six months for grants issued prior to May 3, 2007) following his or her termination due to death or disability. If a participant is terminated for cause, all options generally will automatically expire. If a participant dies after termination of service but while an option is still exercisable, the portion of the option that was Chief Scientific Officer at Large Scale Biology Corporation,vested and exercisable as of the date of termination will generally expire twelve months (six months for grants issued prior to May 3, 2007) following the participant’s death. In no event will an option be able to be exercised later than the expiration of its term.

Restricted Stock and Stock Units. Awards of shares of common stock, or LSBC, whose proteomics division he foundedawards designated in 1985units of common stock, may be granted on such terms and ledconditions and subject to such repurchase or forfeiture restrictions, if any, which may be based on continuous service with the Company or its subsidiaries or the achievement of performance criteria, as determined by the Committee. Until the lapse of the restrictions, recipients may not dispose of their restricted stock. The Committee, in its sole discretion, may waive the repurchase or forfeiture period and any other terms, conditions or restrictions on restricted stock and stock units under such circumstances and subject to such terms and conditions as the Committee deems appropriate.

Performance Stock and Performance Units. The Committee may grant awards of shares of common stock or awards designated in units of common stock and determine the length of the performance period and the other terms and conditions of such award. An award of performance stock or performance units will entitle the participant to a payment in shares of common stock, cash or a combination, as the Committee may determine, upon the attainment of performance criteria and other terms and conditions specified by the Committee. Notwithstanding the satisfaction of any performance criteria, the number of shares to be issued or the amount of cash to be paid under an award may be adjusted on the basis of such further consideration as the Committee determines.

Cash-Based Awards. The Committee is also authorized to grant to participants incentives payable in cash subject to terms and conditions determined by the Committee. No more than five million dollars may be granted as a cash-basis award to any one participant in any calendar year. It is intended that cash-based awards under the Plan will normally depend on meeting Performance Goals.

Stock Appreciation Rights (“SARs”). SARs may be granted alone (“freestanding”) or in addition to other awards and may, but need not, relate to a specific option granted under the Plan. Upon exercise of an SAR, the holder is entitled to receive the excess of the fair market value of the shares for which the right is exercised over the grant price of the SAR. The Committee may impose any conditions or restrictions on the exercise of an SAR as it deems appropriate, however, under the Plan the grant price of a freestanding SAR will not be less than the fair market value of the Company’s common stock for the date of grant and the term will not be more than ten years. Payment upon such exercise will be in cash, stock or any combination of cash or stock as determined by the Committee. Any related option will no longer be exercisable to the extent the SAR has been exercised, and the related SAR will generally be canceled to the extent the option has been exercised.

Shares Subject to the Plan

Number of Shares Reserved for Issuance. The Plan initially was authorized to issue up to 6,800,000 shares of our common stock. At the end of fiscal year 2006, approximately 500,000 shares remain available for issuance under the Plan. As amended and restated, the Plan is authorized to issue up to 14,300,000 shares of our common stock of which approximately 8,000,000 are available for future issuance under the Plan. Shares of common stock covered by an award granted under the Plan will not be counted as used

unless and until they are actually issued and delivered to a participant. Shares relating to awards granted under the Plan that lapse, are canceled or forfeited, or otherwise terminated are available for grant under the Plan. However, from and after May 3, 2007, shares of common stock covered by a stock-denominated award settled in cash or not issued because they were tendered by a participant or retained by the Company as full or partial payment to the company for the exercise price of an Award or to satisfy tax withholding obligations in connection with an Award will not be available for future grant under the Plan. Awards made to assume or convert awards in connection with acquisition transactions will not reduce the number of shares authorized for issuance under the Plan. The shares of stock deliverable under the Plan may consist in whole or in part of authorized and unissued shares, treasury shares or a combination thereof. The Committee shall adjust the aggregate number of shares or the awards under the plan in the event of a reorganization, recapitalization, stock split, stock dividend, spin-off, combination, corporate exchange, merger, consolidation or other change in the shares of common stock or any distribution to shareholders other than regular cash dividends or any transaction determined in good faith by the Committee to be similar to the listed transactions. The closing price of the Company’s common stock, as reported on Nasdaq on March 8, 2007, was $41.21 per share.

Limitations on Use of Shares Subject to the Plan. The Committee may not make awards under the Plan to any one participant in any calendar year that relate to more than 500,000 shares of common stock. Of the 14,300,000 shares authorized under the Plan, not more than 1,000,000 shares that may be issued pursuant to awards, other than options and cash-based awards.

Performance-Based Compensation under Section 162(m)

Under Section 162(m) of the Code, the Company is generally prohibited from deducting compensation paid to the Chief Executive Officer priorand the four other most highly compensated executive officers of the Company in excess of $1,000,000 per person in any year. However, compensation that qualifies as performance-based is excluded for purposes of calculating the amount of compensation subject to its merger in 1999 with Biosource Technologies, which created the current LSBC. He founded, along with Dr. Norman Anderson,$1,000,000 limit. In general, the Molecular Anatomy Program atCommittee can determine the Argonne National Laboratory in Chicago where his workterms and conditions of awards. If the Committee intends to qualify an award as “qualified performance-based compensation” under Section 162(m) of the Code, the performance goals it may choose include any or all of the following or any combination thereof: net income (earnings less interest and taxes); EBITDA (earnings before interest, taxes, depreciation, amortization and non-recurring and non-cash charges or any combination thereof); gross margin; operating margin; revenue growth; net cash flow (EBITDA less capital spending, taxes paid, interest paid, payments for one-time nonrecurring items such as restructuring cost and adjusted for the change in the developmentmanaged capital base which includes trade account receivable, net inventory, pre-paids, accounts payable and accrued liabilities and other operating related cash inflows and outflows) or other cash flow(s) including operating cash flow, free cash flow, discounted cash flow return on investment and cash flow in excess of 2-D electrophoresis and molecular database technology earned him, among other distinctions,cost of capital (or any combination thereof); earnings or operating earnings per share (primary or fully diluted); economic value added; cash-flow return on investment; income (pre-tax or net); total shareholder return; return on investment; return on equity; return on assets; return on sales; return on invested capital; the American Associationattainment by a share of common stock of a specified fair market value for Clinical Chemistry’s Young Investigator Award for 1982 anda specified period of time; an increase in the 1983 Pittsburgh Analytical Chemistry Award.

James G. Andress was appointed asfair market value of a director on October 3, 2002 and is Chairpersonshare of common stock; customer satisfaction metrics; regulatory compliance metrics; revenue; net operating profits after taxes; debt to equity ratio; price/earnings ratio; market share; expense ratios; expense reduction; completion of key projects; any individual performance objective measured solely in terms of quantitative targets related to the Company, or its business; or any increase or decrease of one or more of the Compensation Committee andforgoing over a memberspecified period (the “Performance Goals”). Performance Goals may be stated in absolute terms or relative to comparison companies or indices to be achieved during a period of time. Performance Goals may relate to the performance of the Governance Committee. From 1996 through 2000, Mr. Andress served as President and Chief Executive Officer of Warner Chilcott, PLC. Warner Chilcott is a pharmaceutical company that develops prescription drugs in the areas of women’s health care, urology, dermatology and cardiology. He was appointed Chairman of Warner Chilcott, PLC in 1998. Mr. Andress is a director and ChairmanCompany, any subsidiary, any portion of the Auditbusiness, product line or any combination thereof, relative to a market index, a group of companies (or their subsidiaries, business units or product lines), or a combination thereof, all as determined by the Committee. The Committee of publicly-held The Allstate Corporation; a director and Chairman of the Audit Committee of publicly-held Xoma Corporation, a biopharmaceutical development company; and a director of Sepracor Inc., a research based pharmaceutical company.

Directors with Terms Expiring in 2008 (Class 3)

Richard W. Roedel was appointed as a director on October 3, 2002 and is Chairperson of the Audit Committee. From 1985 through 2000, he was employed by BDO Seidman, LLC first as an Audit Partner, later being promoted in 1990 to Managing Partner in Chicago and then Managing Partner in New York in 1994 and finally in 1999 to Chairman and Chief Executive Officer. In October of 2002, he joined the

shall

have absolute discretion to reduce the amount of the award payable to any participant for any period below the maximum award determined based on the attainment of Performance Goals, and the Committee may decide not to pay any such award to a Participant for a period, based on such criteria, factors and measures as the Committee in its sole discretion may determine, including but not limited to individual performance or impact and financial and other performance or financial criteria of the Company, a subsidiary or other business unit in addition to Performance Goals.

Change in Control

Under the Plan, to maintain all of the participants’ rights in the event of a Change in Control of the Company (as described below), unless the Committee determines otherwise at the time of grant with respect to a particular award: (1) all options and stock appreciation rights shall become fully exercisable and vested to the full extent of the original grant; (2) all restrictions and deferral limitations applicable to any restricted stock or stock units shall lapse; (3) all performance stock and performance units shall be considered to be earned and payable in full, and any deferral or other restriction shall lapse and such performance stock and performance units shall be immediately settled or distributed; and (4) any restrictions and deferral limitations and other conditions applicable to any other awards shall lapse, and such other awards shall become free of all restrictions, limitations or conditions and become fully vested and transferable to the full extent of the original grant.

In connection with a Change in Control, the Company may cancel awards under certain circumstances if the participant is given a reasonable opportunity to exercise rights prior to the consummation of the Change in Control and to the extent applicable, participate in such sale as a shareholder. Without limitation of the preceding sentence, the Committee may, but is not be obligated to, provide in connection with a Change in Control a cash payment to participants in consideration for the cancellation of awards.

Change of Control is defined under the Plan generally to include: (1) acquisition of 30% of the voting shares of the Company; (2) change in more than 50% of the Board in any two year period unless the new directors are approved by more than 50% of the old directors; (3) a merger, consolidation, reorganization or similar event unless: (i) persons before such event who own more than 50% of the voting shares own more than 50% of the voting shares after the event in substantially the same proportions as before the event; (ii) Board members before the event constitute more than 50% of the Board members after the event; and (iii) no person who did not own 30% before the event owns 30% of the voting shares after the event; (4) a sale, transfer, lease or other disposition of all or substantially all the assets unless the exception set forth immediately above regarding mergers applies; or (5) a liquidation or dissolution.

Nonassignability of Awards

Unless the Committee determines otherwise, no award granted under the Plan may be sold, assigned, transferred, pledged or otherwise encumbered by a participant, other than by will, by designation of a beneficiary, to the extent permitted by the Committee, or by the laws of descent and distribution.

Term, Termination and Amendment

Unless earlier terminated by the Company’s Board of Directors, the Plan will terminate on May 26, 2014. The Company’s Board of Take-Two Interactive Software, Inc. as ChairmanDirectors or the Committee may generally amend, suspend, or terminate all or a portion of the AuditPlan at any time, as long as any rights of a participant are not materially adversely affected without the participant’s consent, subject to shareholder approval to the extent necessary to comply with stock exchange rules or regulatory requirements. The Committee and served in several capacities through June 2005, including Chairman and Chief Executive Officer. Mr. Roedel is a director and Chairmanmay amend the terms of any award granted, prospectively or retroactively, but cannot, except as it determines appropriate to avoid or mitigate the imposition of additional taxes under section 409A of the AuditCode, materially adversely affect the rights of any participant without the participant’s consent. The Committee may not reprice options or SARs without shareholder approval.

11

U.S. Federal Income Tax Consequences

The following briefly describes the U.S. federal income tax consequences of publicly-held Brightpoint, Inc.the Plan generally applicable to the Company and to participants who are U.S. citizens.

Stock Options

A participant will not recognize taxable income upon the grant of an option under the Plan. Upon the exercise of an option, a participant will recognize taxable ordinary income equal to the excess, if any, of the fair market value of the shares on the date of exercise over the option exercise price. Upon subsequent disposition of such shares, the participant will realize short-term or long-term capital gain or loss, with the basis for computing such gain or loss equal to the option exercise price plus the amount of ordinary income realized upon option exercise.

Restricted Stock Awards

Upon receipt of a restricted stock award, a participant generally will recognize taxable ordinary income when the shares cease to be subject to restrictions in an amount equal to the excess of the fair market value of the shares at such time over the amount, if any, paid to the Company by the participant for the shares. However, no later than 30 days after a participant receives the restricted stock award, the participant may elect to recognize taxable ordinary income in an amount equal to the fair market value of the shares at the time of receipt. Provided that the election is made in a timely manner, when the restrictions on the shares lapse, the participant will not recognize any additional income. When a participant sells the shares, the participant will have short-term or long-term capital gain or loss, as the case may be, equal to the difference between the amount the participant received from the sale and the tax basis of the shares sold. The tax basis of the shares generally will be equal to the amount, if any, paid to the Company by the participant for the shares plus the amount of taxable ordinary income recognized by the participant either at the time the restrictions lapsed or at the time of election, if an election was made by the participant. If the participant forfeits the shares to the Company (e.g., upon the participant’s termination prior to expiration of the restriction period), the participant may not claim a distributordeduction with respect to the income recognized as a result of wireless devices and accessories and a providerthe election.

Any dividends or dividend equivalents arising with respect to shares of outsourced servicesrestricted stock for which the restrictions have not lapsed generally will be taxable as ordinary income to mobile operatorsthe participant at the time the dividends or dividend equivalents are received by the participant. Dividends arising with respect to restricted stock after the restrictions have lapsed, or with respect to which the election described in the wireless telecommunicationspreceding paragraph was timely made, generally would be subject to a reduced rate of tax under current law.

Stock Unit Awards, Performance Awards and data industry.Other Stock or Cash-Based Awards

A participant will not recognize taxable income upon the grant of a stock unit award or a performance award. Generally, upon the distribution of cash or shares to a participant pursuant to the terms of a stock unit award or performance award, the participant will recognize taxable ordinary income equal to the excess of the amount of cash or the fair market value of shares transferred to the participant over any amount paid to the Company by the participant with respect to the award.

Stock Appreciation Rights

A participant will not recognize taxable income upon the grant of an SAR. Upon the exercise of an SAR, a participant will recognize taxable ordinary income equal to the difference between the fair market value of the underlying shares on the date of exercise and the grant price of the SAR.

Deferred Compensation under Section 409A

If an award under the Plan constitutes nonqualified deferred compensation that is subject to section 409A of the Code, certain requirements must be met (e.g., rules regarding deferral elections, distributions and acceleration of benefits). If the requirements are not satisfied, the participant may have to include an amount in income currently (or, if later, when no longer subject to a substantial risk of forfeiture), and may be subject to an additional tax equal to 20% of the amount included in income plus interest from the date of deferral (at the statutory underpayment rate plus 1%). Options are generally exempted from the requirements of section 409A if certain requirements are satisfied (e.g., if the exercise price can never be less than the fair market value of the stock on the grant date).

Tax Consequences to the Company

In the foregoing cases, the Company generally will be entitled to a deduction at the same time and in the same amount as a participant recognizes ordinary income, subject to the limitations imposed under Section 162(m) described above.

Tax Withholding

The Company is authorized to withhold from any award granted or payment due under the Plan the amount of any withholding taxes due in respect of the award or payment and to take such other action as may be necessary to satisfy all obligations for the payment of applicable withholding taxes. The Committee is authorized to establish procedures for election by participants to satisfy their obligations for the payment of withholding taxes by delivery of the Company’s stock or by directing the Company to retain stock otherwise deliverable in connection with the award.

Awards Granted to Certain Officers

Annual cash incentive performance goals for 2007 have been established for executive officers. Cash incentive awards are determined based on future performance, so the actual awards, if any, cannot now be determined. The table below sets forth the minimum, target and maximum awards that could be paid to the persons and groups shown below for fiscal 2007 depending upon the extent to which the performance goals established by the Committee are achieved. There is no assurance that the pre-established performance goals will be achieved, and therefore there is no assurance that any awards will actually be paid for 2007 or any future performance period. Because awards under the Plan are discretionary, other awards to be made under the Plan are not yet determinable. The table Grants of Plan Based Awards, column L at page 41 shows stock options granted to the named executive officers in fiscal 2006.

| | | | | | Maximum | |

| | Minimum | | Target | | Possible | |

| | Award for

Fiscal 2007 | | Award for

Fiscal 2007 | | Award for

Fiscal 2007 | |

| | $ | | $ | | $ | |

James W.P. Reid-Anderson | | | 0 | | | 1,128,000 | | 3,000,000 | |

Chairman, President and Chief Executive Officer | | | | | | | | | |

John M. Duffey | | | 0 | | | 352,500 | | 1,200,000 | |

Chief Financial Officer | | | | | | | | | |

Dominick M. Quinn(1) | | | 0 | | | 532,798 | | 1,884,900 | |

Executive Vice President | | | | | | | | | |

Hiroshi Uchida(2) | | | 0 | | | 0 | | 0 | |

Executive Vice President | | | | | | | | | |

Mark Wolsey-Paige | | | 0 | | | 400,000 | | 1,200,000 | |

Executive Vice President | | | | | | | | | |

All current executive officers, as a group (5 persons) | | | 0 | | | 2,739,548 | | 8,484,900 | |

All directors who are not executive officers as a group | | | 0 | | | 0 | | 0 | |

All employees who are not executive officers as a group | | | 0 | | | 0 | | 0 | |

(1) The amounts shown for Mr. Quinn have been converted from Euros using the 2006 average exchange rate of 1 Euro = US$1.2566

(2) Mr. Roedel is a director of publicly-held HIS, Inc., a global provider of critical technical information, decision support tools and related services to the energy, defense, aerospace, construction, electronics and automotive industries. He is also a director and ChairmanUchida resigned effective January 15, 2007

The affirmative vote of the Audit Committeeholders of Luna Innovations Incorporated, a manufacturer of molecular technology and sensor products and a provider of contract research and development services and a directormajority of the Associationshares represented in person or by proxy at the Annual Meeting and entitled to vote on the resolution is required for approval of Auditamendment and restatement of the Plan. The Compensation Committee Members, Inc., a not-for-profit organization dedicated to strengthening the audit committee by developing best practices. Mr. Roedel holds a B.S. in Accounting and Economics from The Ohio State University and is a Certified Public Accountant.

Samuel K. Skinner was appointed as a director on February 18, 2004. Mr. Skinner was President and Chief Executive Officer of USFreightways from July 2000 to May 2003 and in addition was Chairman of the Board of USFreightways from January 1, 2003 through May 2003. From October 1998Directors has unanimously approved the Plan and the Board of Directors believes it to July 2000, Mr. Skinner was a partner and Co-Chairmanbe in the best interests of the law firm of Hopkins & Sutter. From February 1993 to April 1998, he was President and a director of Commonwealth Edison Company and its parent company, Unicom Corporation. Prior to joining Commonwealth Edison, he served as Chief of Staff to former President George Bush. Prior to his White House service, Mr. Skinner served in the President’s cabinet for nearly three years as U.S. Secretary of Transportation. From 1977 to 1989, Mr. Skinner practiced law as a senior partner in the Chicago law firm of Sidley & Austin (now Sidley Austin). From 1984 to 1988, while practicing law full time, he also served as Chairman of the Regional Transportation Authority of Northeastern Illinois and was appointed by President Reagan as Chairman of the President’s Commission on Organized Crime. From 1968 to 1975, Mr. Skinner served in the office of the United States Attorney for the Northern District of Illinois and in 1977 President Ford appointed him United States Attorney, one of the few career prosecutors to ever hold such a position.shareholders. Mr. Skinner is a director of publicly-held Click Commerce, Inc., a provider of e-business software solutions; DiamondCluster International Inc., a global provider of management consulting services; Express Scripts, Inc., a provider of pharmacy benefit management services; Midwest Air Group, Inc., a licensed commercial air carrier; and Navigant Consulting, Inc., a provider of financial, litigation, healthcare and energy consulting services.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE FOR THE

ELECTION AMENDMENT AND RESTATEMENT OF MESSRS. JAMES W. P. REID-ANDERSON, JEFFREY D. BENJAMIN AND

ALAN S. COOPER AS CLASS 1 DIRECTORS AND FORTHE

ELECTION OF MS. BEVERLY A. HUSS AS A CLASS 3 DIRECTOR DADE BEHRING 2004 INCENTIVE COMPENSATION PLAN

6

Equity Compensation Plan Information

The following table summarizes information about our outstanding stock options and shares of common stock reserved for future issuance under our existing equity compensation plans as of December 31, 2006.

Plan Category | | | | Number of Securities to Be

Issued upon Exercise Of

Outstanding Options,

Warrants and Rights(a) | | Weighted-Average Exercise

Price of Outstanding Options,

Warrants and Rights(b) | | Number of Securities

Remaining Available for

Future Issuance Under

Equity Compensation Plans(c)

(Excluding Securities

Reflected in Column(a)) | |

Equity compensation plans approved by shareholders | | | 6,051,763 | (1) | | | $ | 33.92 | | | | 1,212,035 | (2) | |

Equity compensation plans not approved by shareholders(3)(4) | | | 2,101,864 | | | | $ | 8.14 | | | | 0 | | |

Total | | | 8,153,627 | | | | $ | 27.22 | | | | 1,212,035 | | |

(1) Includes 33,020 restricted stock units granted through December 31, 2006 to employees and non-employee directors under the 2004 Incentive Compensation Plan and 32,019 common stock units under the Dade Behring Non-employee Directors Deferred Stock Compensation Plan. Restricted stock units and common stock units do not have an exercise price and do not affect the value presented in column (b) above.

(2) Includes 534,672 shares under the Dade Behring Employee Stock Purchase Plan and 167,981 shares under the Dade Behring Non-employee Directors’ Deferred Stock Compensation Plan, which were approved by our shareholders on May 28, 2003, and includes 509,382 shares available as of December 31, 2006, under the Dade Behring 2004 Incentive Compensation Plan, which was approved by our shareholders on May 26, 2004. The exercise price for options granted under the Dade Behring 2004 Incentive Compensation Plan is equal to the market price of our common stock at the time we grant the stock option.

(3) Includes 1,900,864 shares subject to outstanding options as of December 31, 2006, issuable pursuant to the Dade Behring 2002 Management Stock Option Plan. Such options were described in the disclosure statement provided in connection with the plan of reorganization and were part of the plan of reorganization approved by all voting classes of creditors and by the bankruptcy court, effective October 3, 2002. The 2002 Management Stock Option Plan provides for the issuance of up to 11,604,708 stock options. On October 3, 2002, 8,212,120 stock options were granted under this plan. Additional grants of 45,200 stock options were made during the remainder of 2002. Forty percent of such stock options vested on January 1, 2003, with an additional 20% vesting and exercisable at the end of each of the first, second and third anniversaries of the grant dates. The strike price for the 2002 options was $7.36. On February 28, 2003, 314,800 stock options were granted under the 2002 Management Stock Option Plan. The strike price was $8.39. On October 3, 2003, 2,809,324 stock options were granted under the plan. The strike price was $9.20. Additional grants of 284,250 stock options were made during the first quarter of 2004 at the plan formula $9.20 exercise price. For grants in 2003 and 2004, forty percent of the options awarded under this plan vested and were exercisable on the respective grant dates, with an additional 20% vesting and becoming exercisable at the end of each of the first, second and third anniversaries of the grant dates. All option awards issued to executive officers are determined by the Compensation Committee and option awards issued to all other participants are determined by the Chief Executive Officer. Accelerated vesting occurs upon a change of control (as defined in the 2002 Management Stock Option Plan) or termination without cause. Vested and exercisable options generally expire on the earlier of (1) the tenth anniversary of the date

of grant, (2) the six-month anniversary of the employee’s termination date if such termination was the result of death or disability, (3) the 90th day following an employee’s termination date if such termination was the result of anything other than death, disability or termination for cause, or (4) immediately upon termination for cause. Upon a change in control as defined in the option plan, the options can be converted, cashed out or otherwise dealt with in accordance with the option plan. The stock option grants described in this paragraph include the re-grant of 60,986 stock options that were canceled, forfeited, or otherwise terminated without the issuance of shares. Concurrent with the initial approval of the Dade Behring 2004 Incentive Compensation Plan, authority to make further grants under the 2002 Management Stock Option Plan was cancelled.

(4) Includes 201,000 shares subject to outstanding options as of December 31, 2006 issuable pursuant to the Dade Behring 2002 Director Stock Option Plan. Under this plan, options to purchase 50,000 shares of common stock with an exercise price of $7.36 per share were granted to each of six non-employee directors in October 2002. These grants were made to attract and retain qualified persons who are not employees of Dade Behring for service as members of the Board of Directors by providing such members with an interest in the success and progress of our company. The options vested and became exercisable in three installments on the first, second and third anniversaries of October 3, 2002. Vested and exercisable options expire on the earliest of (1) October 24, 2012, (2) the six month anniversary of a director’s termination date, if such termination was the result of death or disability or (3) the 90th day following a director’s termination date, if such termination was the result of anything other than death or disability. The aforementioned grants represent all of the shares issuable under the Dade Behring 2002 Director Stock Option Plan.

16

CORPORATE GOVERNANCE AND DIRECTOR-RELATED MATTERS

Board of Directors

Dade Behring is managed under the direction of an eight member Board of Directors. In fulfilling its duties, the Board of Directors and its Committees oversee the corporate governance of Dade Behring, oversee and advise management in developing our financial and business goals, evaluate management’s performance in pursuing and achieving those goals, and oversee our public disclosures and the disclosure processes. During fiscal 2005,2006, the Board held elevenseven meetings including seventwo telephonic meetings. Each director attended 75%82% or more of the total number of meetings of the Board and of the Committees on which he or she served during the year.

Our policy on director attendance at annual meetings calls for directors to attend the Annual Meeting of Shareholders in the absence of a scheduling conflict or other valid reason. AllExcept for Mr. Skinner, all of the directors then in office attended Dade Behring’s 20052006 Annual Meeting of Shareholders held on May 23, 2005.24, 2006.

Executive sessions of non-management directors are generally held incident to regular Board meetings. The non-management directors have not designated a lead director; instead, executive sessions are led by the Committee chair or other director proposing the agenda item. Any non-management director can propose agenda items or request that an additional executive session be scheduled.

Independence

The Board of Directors has determined that each of the seven non-management directors, including all members of the Audit, Compensation and Governance Committees are “independent” as defined by applicable listing standards of The Nasdaq Stock Market currently in effect and approved by the Securities and Exchange Commission (the “SEC”), and all applicable rules and regulations of the SEC, and that each is an “outside director” for purposes of RuleSection 162(m) of the Internal Revenue Code of 1986, as amended and a non-employee director for purposes of SEC Rule 16b-3.

Financial Expertise

The Board of Directors has determined that two members of the Audit Committee, Richard W. Roedel and Samuel K. Skinner, possess the attributes to be considered financially sophisticated for purposes of applicable Nasdaq Marketplace Rules and that Richard W. Roedel is an “audit committee financial expert” as defined by the rules and regulations of the SEC.

Board Committees

Our Board has the following three standing Committees: Audit Committee, Compensation Committee and Governance Committee, which also serves as the nominating committee. The Board has adopted a written charter for each of the Committees. Copies of the Committee charters and the Governance Manual adopted by the Board are available under the Corporate Governance heading on the Investor Relations Section of our websiteWeb site at www.dadebehring.com. The membership during the last fiscal year and the function of each of the Committees are described below.

Audit Committee

The Audit Committee assists the Board in fulfilling its responsibilities for general oversight of the integrity of our financial statements, compliance with legal and regulatory requirements, the independent registered public accounting firm’s qualifications and independence, the performance of our internal audit function and the work of our independent registered public accounting firm, and risk assessment and risk management. Among other things, the Audit Committee: prepares the Audit Committee report for

inclusion in this Proxy Statement; annually reviews the Audit Committee charter and the Committee’s

performance; appoints, evaluates and determines the compensation of the independent registered public accounting firm; reviews the scope of the annual audit, the audit fee and the financial statements; pre-approves all audit and permissible non-audit services to be provided by our independent registered public accounting firm; reviews Dade Behring’s disclosure controls and procedures, including internal control over financial reporting, information security policies, the internal audit function, and corporate policies with respect to financial information; establishes procedures for the receipt, retention and treatment of complaints to Dade Behring regarding accounting, internal accounting controls or auditing matters and for the confidential, anonymous submission by our employees of accounting or auditing concerns; oversees investigations into complaints concerning financial matters; approves any related party transactions; and reviews other risks that may have a significant impact on the Company’s financial statements. The Audit Committee works closely with management as well as our independent registered public accounting firm. The Audit Committee has the authority to obtain advice and assistance from, and receives appropriate funding from Dade Behring for, outside legal, accounting or other advisors as the Audit Committee deems necessary to carry out its duties.

The members of the Audit Committee are Richard W. Roedel (Chairperson), N. Leigh Anderson, Ph.D. and Samuel K. Skinner. The Audit Committee held fourteenten meetings, including sevenfour telephonic meetings, during 2005.2006. The report of the Audit Committee begins on page 11.24.

Compensation Committee

Principal responsibilities of the Compensation Committee, as outlined in its charter, are to review, determine and approve overall compensation policy and programs including base salary, short-term and long-term incentive awards and benefits for the Company’s senior management and Chief Executive Officer basedand senior management. The Committee reviews, may adjust and approves each element of compensation that the Chief Executive Officer recommends for members of senior management, (which in this Proxy Statement means all executives reporting directly to the Chief Executive Officer including the Chief Financial Officer and the three additional executive officers named in the Summary Compensation Table which appears on performance evaluations.page 40). Other responsibilities are to approve all senior management and the Chief Executive Officer employmentcompensation related contracts, including severance agreements, to review and evaluate the performance of the Chief Executive Officer, review performance assessments of senior management prepared by the Chief Executive Officer, and to review management’sthe Company’s management succession planningplan and management development recommendations. The Compensation Committee charter does not specifically provide for any delegation of Compensation Committee responsibilities.